Day 12 Investment Banking & Hedge Fund (Career Choices for Women?)

- Valentina Xu

- May 31, 2018

- 5 min read

Updated: Jun 1, 2018

Today is my twelfth day at CoreNetwork Fund. Since most of the projects are done, I decided to spend some time to research different jobs in the financial sector and explore some career choices. I remembered that the other day, there was a mind-blowing stat about VC employees: According to CB Insights, 1% of founders with venture capital is black, another 12% of are Asian, and 87% are white. It also shows that 92% of VC-backed founders are male, and 86% of founding teams are all male. If I had not have the experience of constantly looking at the teams in VC while I was doing the sourcing, I would not be able to believe this stat. However, I was more convinced that the stat from 2017 was real, after simply looking around the people at where I work.

While I was thinking about this stat, today’s Pitchbook newsletter had an article titled “How many billion-dollar companies have female founders?” I quickly clicked the title to read it without even blinking my eyes. According to Pitchbook, “Of the 134 VC-backed US-based companies valued at $1 billion or more, aka "unicorns," just 14 have a woman co-founder.” Is it just in the U.S. that the gender ratio in VC is drastic? No, globally speaking, out of 239 billion-dollar VC-backed companies, only 23 have a female founder.

Notably, the highest valuation ($56 B) VC founded by female is a Chinese woman called Jean Liu (president of DiDi, an app similar to Uber, now China’s largest mobile transportation platform). I had heard of Jean before, and I think she truly was an inspiration because not only did she had the intelligence and grit to lead many big companies like Apple, Facebook, Alibaba to invest in DiDi, she also had a heart for the underprivileged women and autistic children, as she established charity funds to support them using transportation.

After some inspiration, I started my research of today: discovering what Investment Banking and Hedge Fund careers are like (as I haven’t known much about these two financial sectors yet). By getting to know more what these financial institutions do, I wanted to compare and see among all the ones I have experienced or researched, which one I am the most interested in. I used a very helpful website called Vault, which basically gave me an overview of the financial sector, companies that are in that sector, employee reviews, and jobs.

Investment Banking is in fact neither investing nor banking, it is raising capital for companies and governments and advising them on financing and merger alternatives. Investment banks act as the intermediary of sellers (companies who want to gain cash by selling their securities in forms of stocks, bonds, or loans) and buyers (the investing public). An investment banker essentially does 3 things: 1) offers his or her expert advice and counseling on pricing securities to be offered for sale, 2) fills the registration documents with government agencies, 3) manages the sales distribution syndicate, in addition he or she communicates periodically with the investor community.

Two of the most prestigious investment banks are Goldman Sachs and JP Morgan. One thing I liked about them is that they have branches in different countries in U.S., Asia, Europe, which applies to one of my ideal job setting (being able to travel and live in different countries). Some of the common working culture in these two companies are:

Ups:

1) “Great culture and colleagues—working with very smart, driven, motivated people”

2) “Career development opportunities are truly unlimited”

3) “Commitment to mentorship and career development”

Downs:

1) “High expectations—the work is demanding”

2) “Work/life balance”

3) “Sometimes the processes to accomplish projects can be slow because it’s a big company”

Much like any type of investment companies, Hedge Funds are an “alternative investment” which means to operate unregulated funds, and it includes private equity and real estate. Similarly, mainstream funds are investment funds that everyday investors can purchase; mutual funds are the prime example of a mainstream fund. There are different types of hedge funds for different specialties. For example, there are Equities (stock market), Arbitrage(Risk and merger), Macro (given nation's interest rate policy, which can affect bonds and currencies), Distressed Companies and Debt (buying whole companies), Big Bank Hedge Funds (designed to keep wealthy clients' money in-house). Or if there are more than one speciality, a lot of hedge funds classified themselves as Multistrategy.

To have a hedge fund career, a bachelor’s degree is the minimum requirement, but those working on the investment side often have a master’s degree or even a Ph.D. in finance, mathematics, economics, financial engineering, quantitative finance, programming, marketing, or business administration. The meritocracy in Hedge Fund reward system tells me that the higher the degree, the more of the experience, and the more advanced the investment mindset is, the better a person will perform well in a hedge fund career.

The work culture in Hedge Funds is usually less structured than it is at an investment bank or mutual fund. The work environment tends to be cohesive and collaborative since the entire firm is usually focused on the success and performance of the fund. However, exceptions can also be made depending on the owner and team members. I think if I decided to go into this type of work environment, I would do research on the firm’s employee reviews and visit the firm before devoting to work for it.

Before lunch, I finished researching, feeling excited to see what future could be like with these types of careers but also rethinking if this really is the path I wanted for a meaningful life. Then, after enough research and thinking, it was the time to meet with Erik and present CoreNetwork Fund’s new site mapping. Erik seemed pretty satisfied with it and asked me to email him the pictures.

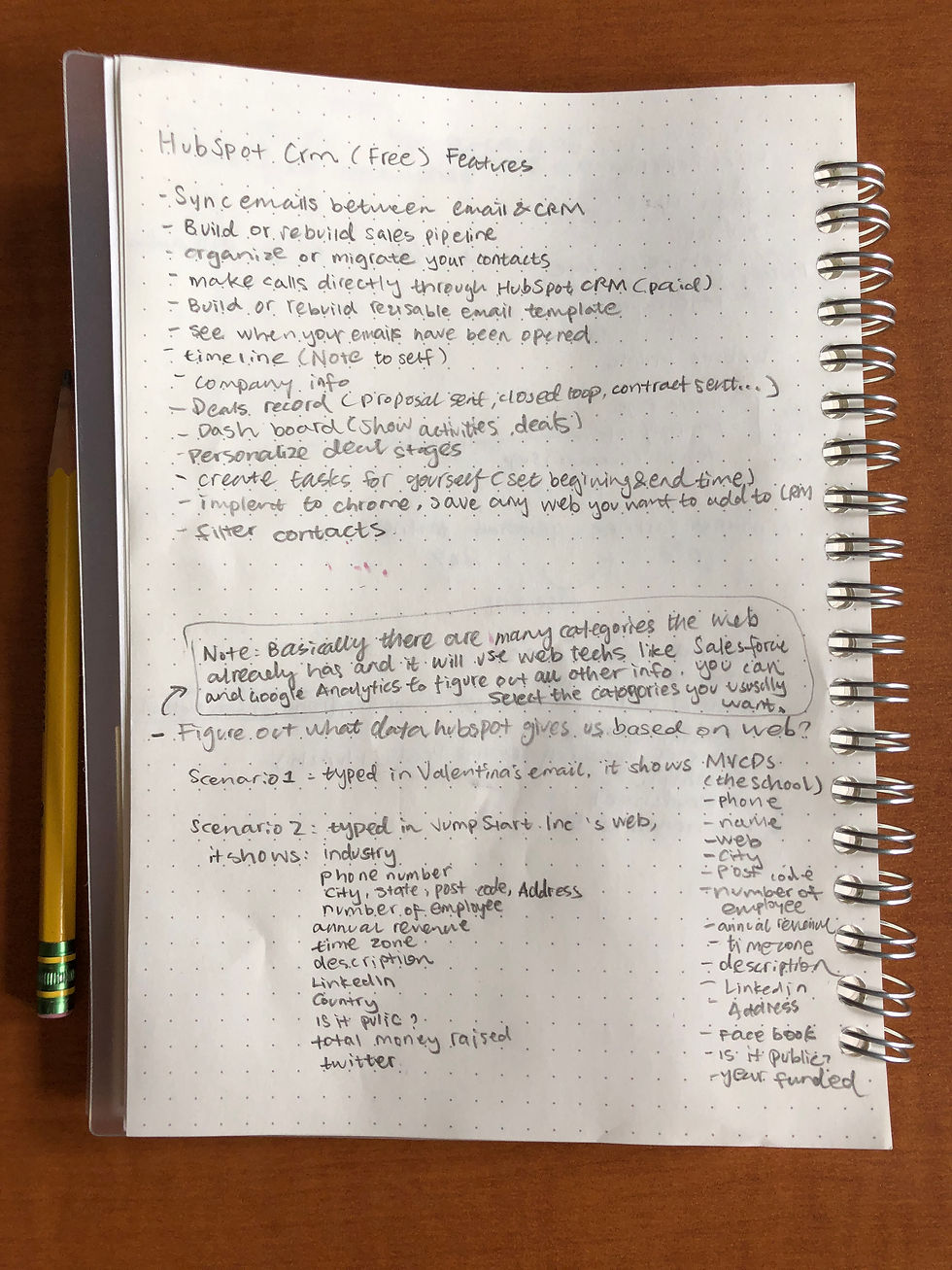

In the afternoon, I had a task to figure out how to use HubSpot CRM (The customer relationship management software that I created) and more specifically, what type of information can this software automatically draw from companies when only a name or a website is provided? I approached this task by watching a lot of tutorial videos from the website and took notes. I also tried 2 scenarios: the first I typed in a person’s email address, and the second I typed in a company’s name and investigated what information HubSpot could draw. It was a really neat software, because after the tutorial and trials, I learned how appropriately using this free software can save so much time comparing to the traditional method of using spreadsheet. It’s always good to try the new technology out there because using the just right one can improve work efficiency.

I think today's research on career choices is helpful and though it wasn't one of my specific goals, I was learning and thinking a lot for the first time about these different financial sectors. By learning more on HubSpot CRM, I hit my goals of finishing up my project on the VC Fundraising. More specifically, looking at the different filters in the CRM system, I learned more about factors VC care about when they pipeline a prospect list. Tomorrow is my last day at CoreNetwork Fund. I will be wrapping up all the projects I started. It has been a real life experience and I appreciate the opportunity to do it before going to college.

Thank you, Valentina. Nice post. I think you could find a career as a VC if you wanted. Because there are so few women in the field, they will be looking for women with your talents!